💡 Introduction

When Ark Invest makes a move, the financial world watches—and this week, it’s watching closely. In a bold play, the firm has scooped up $30 million in Coinbase shares and added another $17 million in BitMine across three of its major ETFs. This dual acquisition signals a growing confidence in crypto and blockchain infrastructure, even as the markets continue to experience turbulence. But what does this mean for investors and the broader crypto landscape?

🏦 Who is Ark Invest?

Ark Invest, led by the high-profile Cathie Wood, is a disruptive innovation powerhouse. Founded in 2014, the firm is known for its forward-thinking approach, often betting big on emerging technologies like artificial intelligence, blockchain, biotech, and robotics.

Wood’s investing mantra? High-conviction, high-disruption, and high-reward.

📊 The Big Move – Coinbase and BitMine Investments

In late July 2025, Ark Invest executed two major buys:

- $30 million worth of Coinbase (COIN) shares

- $17 million worth of BitMine stock across ARKK, ARKW, and ARKF

These aren’t random purchases. They are deliberate steps in Ark’s strategy to double down on crypto and blockchain exposure.

🪙 Coinbase Purchase in Detail

So, what’s the scoop with Coinbase?

- Ark bought ~450,000 shares, depending on the price at the time

- The purchase came after Coinbase stock dipped slightly on regulatory concerns

- Cathie Wood has long been bullish on Coinbase as a gateway to the crypto economy

Coinbase remains one of Ark’s top holdings, and this move only strengthens that position.

⛏️ BitMine Acquisition Details

BitMine isn’t a household name—yet.

- It’s a blockchain mining company focused on sustainable operations

- Ark added BitMine across three of its funds, indicating multi-sector confidence

- BitMine is increasingly attractive due to its energy-efficient models and data center expansion

Why is this important? Because the future of crypto mining must be both profitable and planet-friendly—and BitMine is checking both boxes.

📦 The Three Ark Funds Involved

Let’s look at the ETFs Ark used for these purchases:

ARK Innovation ETF (ARKK)

- Focus: Disruptive innovation

- Added the bulk of the Coinbase shares

ARK Next Generation Internet ETF (ARKW)

- Focus: Internet-based platforms, including blockchain

- Included both Coinbase and BitMine buys

ARK Fintech Innovation ETF (ARKF)

- Focus: Financial tech, digital wallets, and blockchain

- Added BitMine due to its fintech overlap

💹 How Each Fund is Structured

Each ETF has a unique flavor:

- ARKK: Heavy in high-risk, high-reward innovation bets

- ARKW: Web3, cloud computing, and metaverse-friendly

- ARKF: Payments, digital currencies, and banking disruption

With the BitMine and Coinbase buys, Ark is reinforcing its crypto foundation across these strategic fronts.

📈 Market Reaction and Trends

When the news hit the wires, the market reacted quickly.

- Coinbase jumped nearly 4% intraday after the purchase was publicized

- BitMine also saw increased volume and speculative interest

- Bitcoin and Ethereum both saw mild upticks as investor sentiment leaned bullish

🌐 Coinbase and BitMine Market Impact

What happens when a major investor bets on crypto?

- It signals confidence despite market volatility

- It draws in retail investors and institutional observers

- It helps validate crypto infrastructure as a serious long-term asset class

🧠 Cathie Wood’s Crypto Strategy

Cathie Wood isn’t new to the blockchain game. She’s been:

- Vocal about Bitcoin reaching $1 million

- Consistent in her defense of decentralization

- Aggressive in reallocating Ark’s portfolios to crypto-related tech

This latest move is just another dot on the trendline of Ark’s crypto commitment.

⚠️ Risks and Criticism

Let’s not sugarcoat it—crypto is risky.

- Regulatory pressure from the SEC and global agencies

- Volatility from market sentiment and macroeconomic shifts

- Mining’s environmental impact still under scrutiny

Critics argue that such aggressive bets expose Ark to concentrated risk. But that’s never stopped them before.

📈 Opportunities and Growth Potential

There’s also a lot of upside.

- Blockchain is no longer niche—it’s becoming essential infrastructure

- Coinbase has potential to become the NASDAQ of crypto

- BitMine could ride the next wave of green crypto mining

If these companies continue growing, Ark’s bets may look visionary in hindsight.

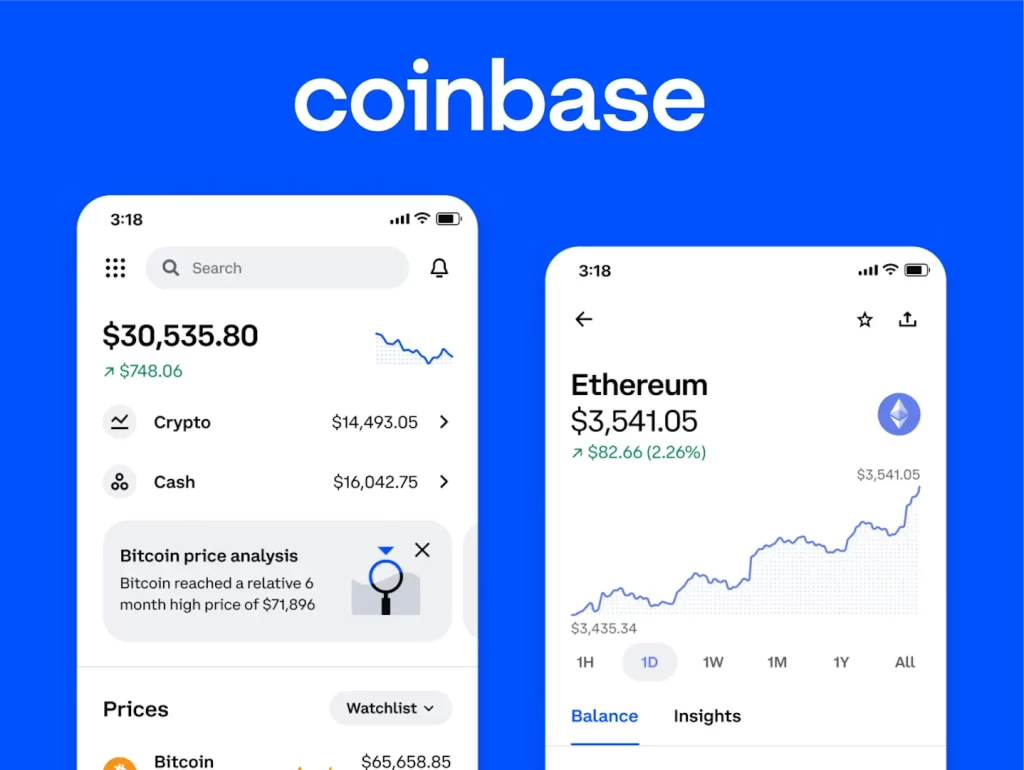

🧩 Coinbase as a Gateway

Think of Coinbase as the App Store of crypto—it’s where the masses enter. It provides:

- Onboarding for new users

- Easy access to Bitcoin, Ethereum, and DeFi tokens

- Growing institutional features

That’s why Ark keeps stacking it.

🔋 BitMine’s Expansion

BitMine is going beyond just mining:

- Building out data centers

- Investing in AI-driven mining optimization

- Pursuing low-carbon strategies to meet ESG targets

They’re positioning themselves as Tesla meets Bitcoin in the mining world.

👨👩👧👦 How This Affects Retail Investors

You might be thinking—should I buy in too?

That’s a personal call, but Ark’s conviction suggests there’s long-term value here. If you believe in crypto’s future, these moves can be a signal—not a guarantee.

🌍 The Bigger Picture: Institutional Crypto Adoption

The more institutions like Ark Invest buy in:

- The more crypto gets mainstream validation

- The more likely regulatory clarity follows

- The more crypto becomes too big to ignore

Ark’s buys may inspire other hedge funds and ETFs to follow suit, accelerating adoption.

✅ Conclusion

Ark Invest’s $30 million investment in Coinbase and $17 million in BitMine isn’t just another buy—it’s a bold endorsement of crypto’s future. While the markets remain volatile, Ark’s continued confidence in blockchain-based companies shows their high-conviction belief in decentralized finance and infrastructure. For investors, this could be a moment to watch—or a moment to act.

Because they see blockchain as foundational to future financial systems, much like the internet was in the early 2000s.

Coinbase is a gateway platform with mass adoption; BitMine offers scalable, green infrastructure for crypto mining.

Not necessarily a signal, but definitely a vote of confidence from a major player.

Still high-risk due to volatility and regulation, but potential returns remain significant.

Given their track record, it’s very likely they’ll continue expanding into the blockchain ecosystem.